Résumer cet article :

Ah, the famous children’s savings account… It’s opened at birth, a few coins are deposited on each birthday, and we hope that in 18 years, there will be enough to finance the driving license, studies, or even the first apartment. But let’s be honest: with the livret A yielding an escargot-like performance, motivation is not exactly high. What if we shifted gears? StackinSat offers a breath of fresh air: the Bitcoin savings account for children. Yes, you read that right: Bitcoin for kids. And this is far from a silly idea!

Bitcoin, the new safe haven? Financial giants no longer doubt it

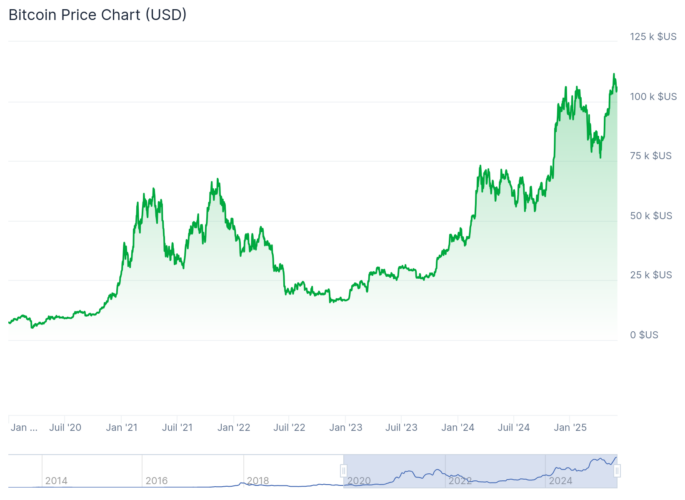

A few years ago, talking about Bitcoin at a family meal would expose you to suspicious glances, between “it’s worthless” and “you’ll end up bankrupt.” But the situation has changed radically. Today, BlackRock, Fidelity, Ark Invest, and even Blackstone are pouring billions into Bitcoin ETFs, elevating the cryptocurrency to the status of a must-have asset on global markets. Larry Fink, the head of BlackRock, who finances even certain countries (no less), now talks about Bitcoin as a “new standard for value exchange on a global scale.” We are far from the crypto wild west: Bitcoin is now in the portfolios of pension funds, banks, and institutional investors, who see it as a bulwark against inflation and the depreciation of traditional currencies.

To compare to gold, which has always been THE safe haven: a kilo of gold, currently priced similarly to Bitcoin, has increased by 95% in 5 years.

Whereas Bitcoin has increased by 1200% 😱

We’re not talking about the livret A… Well, yes: it has gone from 0.50% in 2020 to a staggering 3% in 2023… Clearly, it won’t enrich your children (nor you for that matter!).

Why a Bitcoin savings account for children? The obvious choice in the long term

So, is it too late to invest? Bitcoin is soaring, currently surpassing $105,000, whereas it was barely at $26,000 two years ago. Some wonder if the party is already over. However, experts agree: for those looking at the long term (typically, an investment for children), the question of “the right time” doesn’t really make sense. The most cautious projections estimate Bitcoin to be around $200,000 by 2030, and some don’t hesitate to mention $500,000 or even $1 million in the coming decades. Standard Chartered, Bernstein, Fundstrat, VanEck… all are revising their forecasts upward, spurred by the massive arrival of institutional investors and the programmed scarcity of Bitcoin. If giants like BlackRock are investing billions, it’s surely not just to gamble. They know ;-)

With massive buying pressure generated by the ETFs, such a rise is inevitable.

Matt Hougan (Bitwise)

And then there’s the relentless mechanics: only 21 million Bitcoins will ever exist, never more. No central bank printing presses, no dilution. The result: the higher the demand, the higher the value. This scarcity makes Bitcoin a kind of “digital gold,” a disinflationary asset designed to withstand crises and the test of time.

StackinSat: the Bitcoin savings account, kid version (and hassle-free)

This is where StackinSat comes in, with a solution that feels delightfully simple. It’s a service I previously presented several years ago and which is still operational in my home. It’s straightforward: once the standing order is set up, the service is entirely forgettable.

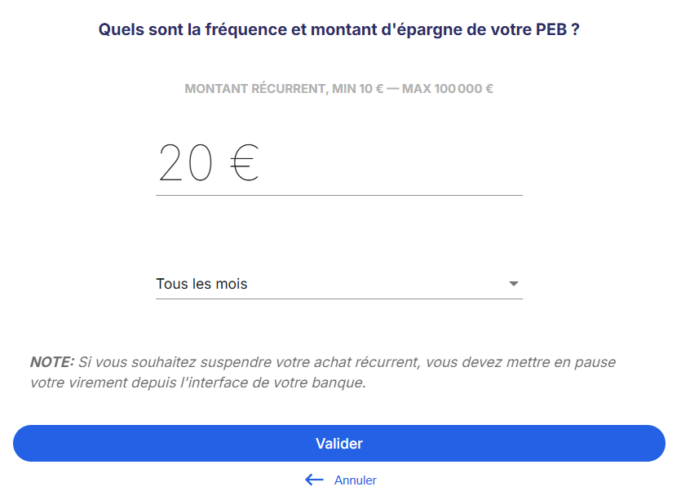

Forget obscure platforms, endless wallets, and English interfaces: StackinSat allows you to open a Bitcoin savings account for children in just a few clicks, starting from only €10. You set up a regular transfer (monthly, weekly, up to you), and StackinSat takes care of converting your euros into Satoshis (the smallest unit of Bitcoin, so that even a small deposit has weight). Indeed, despite the current price of Bitcoin, it’s not mandatory to buy a whole Bitcoin (thankfully!). You can purchase just a tiny fraction, starting from only €10.

The principle? You open a dedicated account in the child’s name, set the amount and frequency of transfers, and Bitcoin accumulates quietly, without the need to monitor the market’s roller coasters. This is what’s called DCA (Dollar Cost Averaging), a proven method to smooth out fluctuations and avoid buying “at the peak.”

And the best part: each account is independent. You can open an account for each child, each with its own goal (driving license, studies, trip to Japan, let’s be adventurous!). Upon reaching adulthood, the child receives the private key and becomes the master of their Bitcoins. The surprise at 18 is likely to be memorable: “Here’s your account… and by the way, you might be a millionaire (or close)”.

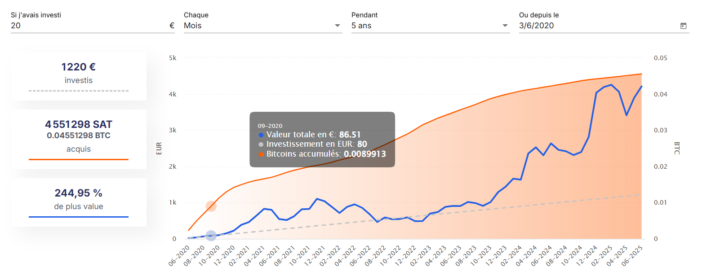

StackinSat offers a simulator on its site. If, for instance, one had invested €20 per month for 5 years, with a total investment of €1220, it would today be worth more than €4200. Nearly 245% profit, which is no small change! Suffice it to say that the driving license will be paid for and there will be some left for a small used car ;-)

I myself chose this solution for my children: every month, a small transfer lands in their StackinSat Bitcoin account. The goal? To give them a nice boost for their driving license or studies, without settling for the traditional “it will yield 1% if all goes well” (unfortunately wiped out by soaring inflation :/). With the current rise of Bitcoin, the performance is already there, but the idea is to play the long game. Who knows? Maybe in 2035, they’ll thank me for betting on the “orange horse” instead of the livret A.

Security and taxation: no traps, but a few rules to know

StackinSat does not hold the Bitcoins: they are sent directly to the wallet of your choice, physical (Ledger, Trezor) or software (BlueWallet, Exodus…). In terms of security, as long as you keep the private key safe, no one can touch your child’s savings. If you prefer convenience, StackinSat can also keep them in a safe.

And what about taxation? As long as you don’t sell the Bitcoins for euros, there’s no tax to pay. Capital gains will be taxed at 30% (flat tax) only upon conversion, which leaves time to see how things unfold. We are also keeping our fingers crossed that taxation will ease for cryptocurrencies in the coming years, as some neighboring countries have so wisely done. 🤞

What if Bitcoin crashes? The risk, yes, but also the potential

Of course, Bitcoin is not without risk. Its volatility can be dizzying, and pessimistic scenarios exist: some analysts mention the possibility of dropping below $20,000 in the event of a major crisis. But in the long run, the trend remains resolutely upward, driven by institutional adoption, scarcity, and growing confidence among investors. As with any investment, it’s important not to put all your eggs in one basket, but it’s hard not to see the children’s Bitcoin savings account as a unique opportunity to diversify and energize family savings.

Conclusion: preparing for children’s futures, but version 3.0

The Bitcoin savings account for children is somewhat like the bet of the century: investing in technology, scarcity, and the silent revolution underway in global finance. With StackinSat, access is simplified, transparent, and suited for families wanting to offer their children something other than a dusty account. The future will tell if Bitcoin fulfills its promises, but one thing is for sure: those who start early will have a head start. And honestly, what parent hasn’t dreamed of offering that little boost that changes everything?

If you have any questions, feel free to ask in the comments, that’s what it’s there for ;-) It’s a service I have been using myself for 4 years: it’s simple, French, and reliable. I can only recommend it!

Please remain courteous: a hello and a thank you cost nothing! We're here to exchange ideas in a constructive way. Trolls will be deleted.